Some Of The World’s Greatest Scams Make You Wonder If People Will Ever Learn

With the rising distrust in financial institutions, frauds and scams may seem like a relatively recent human invention. In reality, as long as money has been around, humans have found a way to take it from others in some shady ways.

These are not your everyday scammers selling you some weight-loss tea — these are fraud masterminds who tricked some of the smartest people out there and got around government and financial roadblocks. The real lesson here is that you should never trust someone named Gregor McGregor... that just sounds shady. These are some of history's greatest scamming masterminds who stole and cheated their way to the top, which only made their fall from grace even more entertaining to watch.

Victor Lustig

Con artist Victor Lustig had been scamming people for years, but in 1925 he completed his biggest con yet: selling the Eiffel Tower. Lustig posed as a government employee tasked with selling the Tower for scrap metal. The landmark had been built for the 1889 Paris Expo and not intended to be permanent, so the lie was believable.

The buyer, Andre Poisson, was suspicious of the secrecy surrounding the deal so confronted Lustig, but by saying he was a corrupt government official, Lustig got away with the money for the tower and a cash bribe. When it became clear it was a con, Poisson was too embarrassed to go to the police, so 6 months later Lustig went back to Paris and sold the tower again. This time, the buyer went to the police, but Lustig had already returned to America.

Charles Ponzi

You can't talk about the greatest frauds in history without mentioning the original financial fraudster, Charles Ponzi. In 1919, Ponzi began the first "Ponzi scheme" by using international reply coupons to make a profit. Because of the difference in value between exchange rates, he could buy them cheap in Italy and make a profit in America.

He promised high returns of up to 45% interest for those who invested in this scheme. Unfortunately, he couldn't figure out a way to turn the coupons into cash and began paying out investors with subsequent investment. It all came apart in 1920, and Ponzi ended up losing his investors over $20 million ($248 million today).

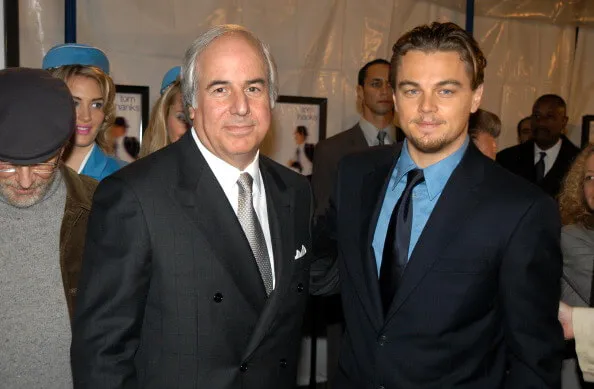

Frank Abagnale

That name may sound familiar if you've seen the 2002 Academy Award-nominated film, Catch Me If You Can. The film tells the tale of real-life con man Frank Abagnale. Abagnale was a master imposter and forger. He mainly obtained his cash by writing fraudulent personal cheques. Abagnale was known for impersonations including an airline pilot, a lawyer, a doctor, and a teacher.

Abagnale evaded authorities multiple times but was finally captured in France in 1969. He was tried in France, Sweden, and eventually sentenced in the United States to 12 years in prison. He now owns a firm which advises companies and the FBI on fraud. In an age of exploring new worlds, who knew it was that easy just to make one up?

Didius Julianus

Known as possibly the first billion-dollar fraud in history, Didius Julianus will go down in history as the guy who bought himself the title of Roman Emperor. In the year 193, the reigning Roman emperor was murdered by his guard. Following this, the army announced that the throne would go to whoever bid the most.

Julianus won the bid, by offering 25,000 sesterces, but after ascending the throne began his fraud. He decreased the value of silver so the purity level of his coins would increase and hold more value. Only nine weeks later he would be executed by the same guard he tried to pay off.

John Brinkley

The "goat-glad doctor" was one of the most notorious fraudsters to grace the medical field in the United States. After buying a fraudulent degree, John Brinkley claimed to be a medical doctor who specialized in curing a variety of male problems. In 1918, a patient came to him asking for help with his impotence. Joking with the patient, Brinkley said he wouldn't be having the problem if he had "a pair of those buck [goat] glands in you." The patient took him seriously and begged Brinkley to perform the surgery, paying $150 for it.

Brinkley would continue giving these operations for $750 each (nearly $10,000 today) even though he knew it would not work. Despite this obvious fraud, his medical license wasn't revoked until 1930 when it was proved he was signing fake death certificates.

Gregor MacGregor

In a scheme almost as outrageous as selling the Eiffel Tower, British army officer Gregor MacGregor invented his own country of "Poyais" that was supposedly inhabited by the native "Cazique" in Central America. In 1921 he managed to get hundreds of French and British investors to buy "Poyaisian" government bonds and land.

This age was ripe with new territories being discovered, so the con was not entirely impossible. But when nearly 300 settlers arrived in "Poyais" they found nothing but untouched jungle. More than half of these settlers died and when the others returned, MacGregor was tried but acquited. He tried to do this same scheme multiple times before moving to Venezuela in 1838. Keep reading to learn about a monumental scam, and the con man behind it who might not even exist.

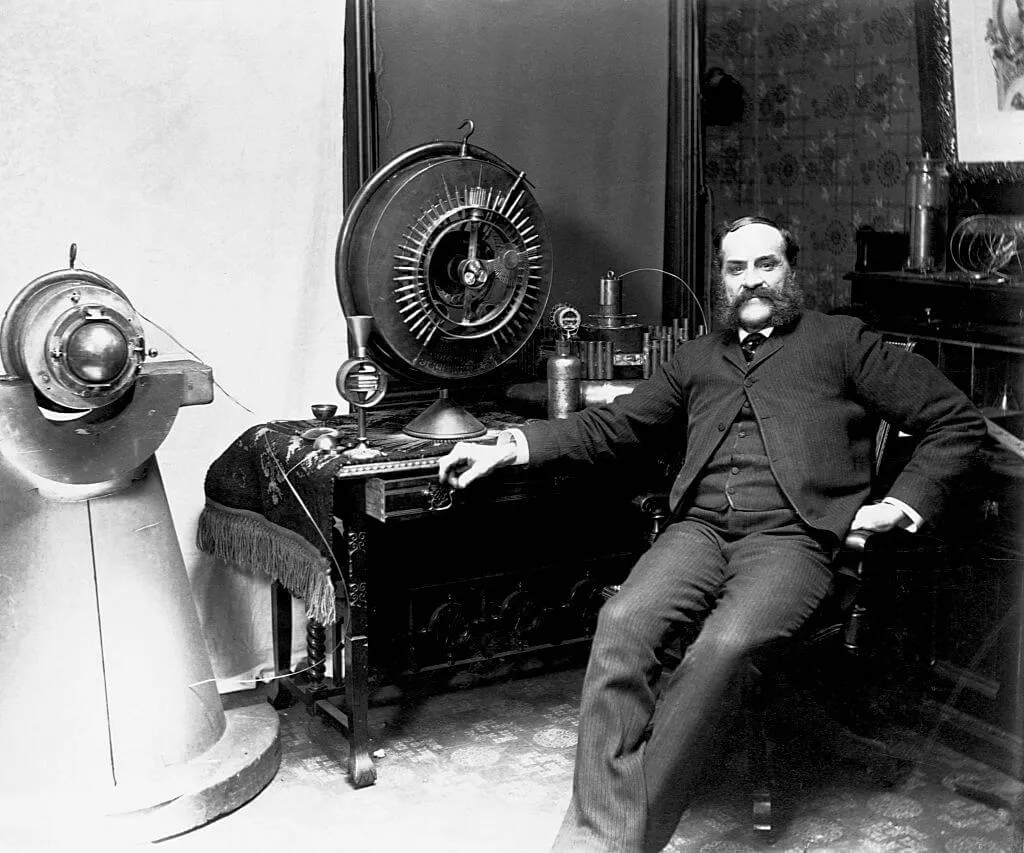

John Keely

John Keely was an inventor from Philadelphia who claimed to have created a new motor that harnessed "ether" in the air to produce energy. Many suspected the motor as a fraud because he would give demonstrations of his motor in his workshop but nowhere else.

This changed in 1881 when he met his wife Clara Moore, who was a wealthy widow and invested $100,000 in the motor (about $2 million today). The two managed to get many stakeholders to invest in the product, and continued to take their money to work on the invention. Nothing came from it, and when Keely died in 1898, The Philadelphia Press investigated his workshop and found a silent water motor and compressed air motor which allowed energy to flow through hidden tubes and wires in the wall and make Keely's inventions appear to work.

Peter Popoff

Faith healing has been widely debated, but televangelist Peter Popoff was exposed as a fraud in 1989. Popoff claimed he had the ability to heal the sick and tell the future and would perform "healing sermons" where he would appear to cure illnesses on television.

Skeptic James Randi exposed Popoff in 1986 on The Tonight Show Starring Johnny Carson. Randi proved that Popoff wore an earpiece and had his wife telling him the names and illnesses of people in the audience. It was also proven that he had many staged performances where fully functioning people would claim to be wheel-chair bound then miraculously walk on stage when Popoff commanded it. Despite being outed as a fraud, he continues to call himself a prophet and his latest scheme has involved selling "Miracle Spring Water."

Arthur Ferguson

Arthur Ferguson is an alleged Scottish con artist who apparently succeeding in selling numerous monuments to gullible American tourists in the 1920s. He apparently sold Big Ben for a £1,000 down payment, Buckingham Palace for a £2,000 down payment, and the White House for yearly payments of $100,000. After trying to sell the Statue of Liberty to an Australian tourist, he was imprisoned until 1930, where he left for Los Angelas.

Ferguson's con may be even more impressive because no one can prove he was real. The earliest references to Ferguson is not until the 1960's and there are no written records of his arrests or releases. Maybe the greatest cons live in legend. Learn the ins and outs of the con man who "made off" with the biggest fraud in American history.

Kamlesh Pattni

In one of the largest political and financial scandals that Kenya has ever seen, Kamlesh Pattni managed to scam 10% of Kenya's GDP. Pattni established Goldberg International which supposedly exported Kenya's gold. But Kenya only had one gold mine at the time, so Goldberg International would smuggle gold into Kenya from Congo, then sell it on the international market.

Goldberg International ended up receiving 35% more from the Kenyan government for selling the gold than they were getting on the return. When this was exposed in 1993, the complicity of many government officials was emphasized more than Pattni, and he walked free of any charges.

Bre-X

Bre-X was a group of companies from Canada which were involved in a 1993 gold mining scandal that was so notorious, Matthew McConaughey would star in a 2016 movie retelling the famous fraud. Bre-X supposedly discovered a gold mining field in 1993 in Indonesia. Their discovery skyrocketed their stock price by hundreds of dollars, but unfortunately for investors, they were faking the gold samples.

A corrupt geologist had been salting the site's samples with gold, which meant that the estimates for the site were far below what people were basing their investments on. Bre-X wasn't able to bounce back from the scandal and the company collapsed in 1997.

Bernie Madoff

In the largest Ponzi scheme and financial fraud in U.S. history, Bernie Madoff nearly made off with $65 billion. Madoff began his career in 1960 by establishing Bernard L. Madoff Investment Securities LLC. At its surface, all the accounts seemed legitimate, but he began promising large returns he couldn't pay. Back office workers for the firm would enter false trading dates and returns to seem like they were making an impressive amount of profit. When he could not make returns, he would take money from other investors to pay out the original ones.

Madoff was investigated 16 times but it wasn't until the 2008 crash that he was exposed. He plead guilty to 11 federal frauds and was sentenced to 150 years in prison. One con man was only caught because his victims wanted to profit as well.

Ivar Kreuger

Ivar Kreuger, also known as the "Match King," was a textbook example of how to get away with fraud by having very successful and legitimate business ventures as well. Kreuger essentially created a monopoly on matches. Due to the popularity of smoking, matches were in high demand in the 1920s when he began his match factories.

But Kreuger did not only manufacture matches, he controlled the entire supply chain for matches. This meant that his company could increase prices as much as they wished without affecting their costs. At its peak, Kreuger was controlling 75% of the world's matches. It wouldn't last though. Uncertain loans and investors cause Kreuger's empire to crash in 1933 following his apparent suicide in 1932.

Enron

Energy company Enronis one of the most recent and volatile frauds in American history. Enron engaged in one of the most blatant forms of fraud. What began as a legitimate trading firm turned into a ticking-time-bomb when accountants in the company began hiding mountains of debt from investors and auditors. Any unprofitable parts of Enron were put in "offshore" accounts to not appear on the official books.

By 1999, they were so in debt that they offered to pay Merrill Lynch & Co. to invest so that they could appear profitable on the books. They were outed in 2001 and suffered the largest corporate bankruptcy seen in American history at that time.

George C. Parker

George C. Parker was another con man who sold landmarks, but rather than preying on able investors, Parker would con unknowing new American immigrants. He used forged documents to sell Madison Square Gardens, The Statue of Liberty, and the Metropolitan Museum of Art to buyers, but wouldn't be caught until he tried to sell the Brooklyn Bridge.

Parker did successfully sell the bridge, but the buyers attempted to set up toll booths on it. When police came to remove the illegal toll booths, they were shocked to hear the buyers thought they legally owned the bridge. Parker clearly underestimated his buyers, and he spent the rest of his life in prison. Mistakes with money in high school would be the downfall of this million dollar company later on.

Jordan Belfort

Jordan Belfort was one of the few con men who has reflected on his past and tried to change it. Belfort began his career in fraud in the 1980s and went on to form his own stock company, Stratton Oakmont. His firm would buy and sell penny stocks in a pump-and-dump style of sales that made him millions.

This style of fraud was so obvious that his company was under surveillance since it started. In 1996, Belfort was convicted and tried, receiving only a 4-year sentence for an exchange of information. He left prison and became an author and motivational speaker, publishing a book recently adapted into the Hollywood blockbuster starring Leonardo Di Caprio, The Wolf of Wall Street.

John Donald Cody

John Donald Cody was a former Army intelligence officer behind a one-man operation of one of the most immoral frauds in history (not that any of them are really all that moral). Cody founded the United States Navy Veterans Association in 2002 as a tax-exempt charity that claimed to assist be assisting U.S. army veterans since 1921.

Following an investigative report, it was shown that the Association did not exist, and was a one-man operation. Cody went on the run for over two years until he was finally captured in 2012 by authorities. Upon his arrest, he was estimated to have frauded the American population out of $20 million in donations to his "charity" and it is unclear if any was ever used to aid veterans.

ZZZZ Best

Barry Minkow began his career in fraud early. He founded ZZZZ Best carpet cleaning while he was still in high school and built it into what appeared to be an extremely profitable business. While the cleaning business appeared to be successful, nearly 90% of its revenue was actually from its involvement in an "insurance restoring" fraud.

ZZZZ Best cleaning was essentially acting as a front for a Ponzi scheme. The Ponzi scheme in insurance restoring continued and was relatively unnoticed until credit card fraud from the early years of the company came back to bite them. Minkow was eventually convicted in 1988 of securities and accounting fraud and went to prison. He didn't learn his lesson though, and upon release formed a fraudulent church and began shorting stocks. Learn about the roots of modern-day scams with one of the first financial investment scams.

Maria Duval

Maria Duval is the Italian born owner of Astroforce, a company she uses to perpetuate a sophisticated mailing scam. Duval claims to be a psychic who has allegedly predicted the stock market, found missing persons and been a consultant to police and celebrities.

Her company sends out letters with these claims on them and allege that Duval had a premonition about the receiver and that they could find out what she knew for a tidy sum. The exact figures are unknown, but some have speculated she has received nearly $200 million worldwide off these mailers. Many have filed complaints against her in the U.K., New Zealand, and the U.S. but she still continues the operation today.

South Sea Company

While it is not the first recorded speculative bubble, actions by the South Sea Company are viewed as the first of the financial era of fraud we know (and hate) today. The South Sea Company was formed in 1711 and granted a monopoly in British trade in the South Pacific.

The Company is one of the first known to have been involved in insider trading, dealing a public debt, and inflating the share price. It peaked in 1720, then creating what is known as the South Sea Bubble, and collapsed a few years later. Nearly 300 years later and it looks like humans haven't learned much from the South Sea Company.